Why I (Finally) Bought Bitcoin

After years of hearing about crypto I decided to jump in

The first time I came face-to-face with Bitcoin was a humid Friday night in Singapore. We were on a pub crawl along a stretch of river that slides past the skyscrapers in the financial district before emptying into Marina Bay.

Several hours into the evening we ducked into an old shophouse and then up a flight of narrow wooden stairs to a bar on the second floor called the Spiffy Dapper.

I stepped inside the dimly lit room and stopped, my eyes drawn to a strange machine against the wall. I stood there a moment, a little drunk and unfocused, and then like the slow ascent of a deep-sea submersible to the brightly lit surface, I realized what it was.

“Hey,” I said to everyone and no one, “that’s a Bitcoin ATM!”

My friends ignored me as they brushed past to find a table, but a customer at the bar turned my way.

“That’s right,” he said. “The first one in Singapore. And my company put it there.”

This was early 2014. I talked to the guy about cryptocurrency and after about 20 minutes I decided to buy some Bitcoin right then and there.

But there was a problem. I didn’t have the right ID with me, or there was an issue with the registration process — it’s hard to remember today — and my friends were finishing up their drinks and getting ready to move on to the next bar. So I never did get some Bitcoin that night.

Which is a shame because a quick back-of-the-envelope calculation tells me that if I had taken the amount of money I spent on that pub crawl and instead put it into the Bitcoin ATM at the Spiffy Dapper, it would be worth about $30,000 today.

So it was an expensive night in terms of missed opportunities. And I guess it was an expensive several years after that because I never got around to buying Bitcoin until October 2020.

Buying Bitcoin

Bitcoin went on a tear in 2020. By October it was up more than 50% and was worth about $11,000.

And I was hearing about cryptocurrency everywhere. It was on the podcasts I followed, in my recommendations on YouTube and even my young son was chirping about crypto tokens in his video games.

I had waited long enough. I bought my first Bitcoin that month.

I then made several more purchases through December and started picking up another cryptocurrency called Ethereum as well.

Today, Bitcoin is bouncing around above $30,000 while Ethereum just touched an all-time high of $1,400.

So I have done well so far. But why did I bite the bullet and finally invest in Bitcoin? There are several reasons but the big one is it’s the future of money.

After centuries of coins, paper and inflation, the world is graduating to cryptocurrency.

Inflation and the Rise of Digital Gold

When we’re taught history as kids, we learn about armies and battles. But these aren’t really what decides history. It’s economics. It’s the ability of countries to finance these armies.

For example, we’re told the sun never set on the British Empire because they had the biggest navy. But that’s not the underlying reason.

The British were able to build the biggest navy because their sophisticated debt market and reputation for repaying debts on time allowed them to borrow massive sums of money.

It’s the same story with the Roman Empire. Yes, it fell because barbarian hordes invaded from the north. But the barbarians succeeded because Rome lost the ability to fund its armies.

The Roman emperors were reckless. They wasted money on lavish lifestyles. And when they ran out of the silver coins they needed to pay for that lifestyle, they started adding cheap metals like tin to their silver coins. Eureka, they had more coins.

But people are smart. The laborers, contractors, food suppliers and others throughout the empire discovered that their payment in ‘silver’ coins no longer contained pure silver.

This meant a horse that could have been bought with a pure silver coin last year, now required two or more of the diluted silver-tin coins to buy the same horse.

As the ‘silver’ coins lost their power to buy things, the emperors responded by making more coins with even more tin. By the time of Claudius II Gothicus in 268 AD the Denarius silver coin contained just 0.02% silver.

It was almost worthless.

This kind of thing still occurs today. In Zimbabwe, the government printed so much paper money (the modern equivalent of adding cheap tin to silver coins) that a loaf of bread eventually cost 35 million Zimbabwean dollars and people swapped wallets for wheelbarrows to carry their money around.

This erosion of money is happening everywhere as governments keep printing more money.

The chart below illustrates the explosion of this money per unit of GDP. It’s just more and more of the emperor’s diluted coins trying to buy the same horse.

Inflation destroys wealth. And rapid inflation can destroy civilizations.

But there’s an old solution to this problem. When reckless leaders devalue our money, we can turn to gold.

Gold is what we call a hard asset with a limited supply. The government can’t just make more after using up what they had.

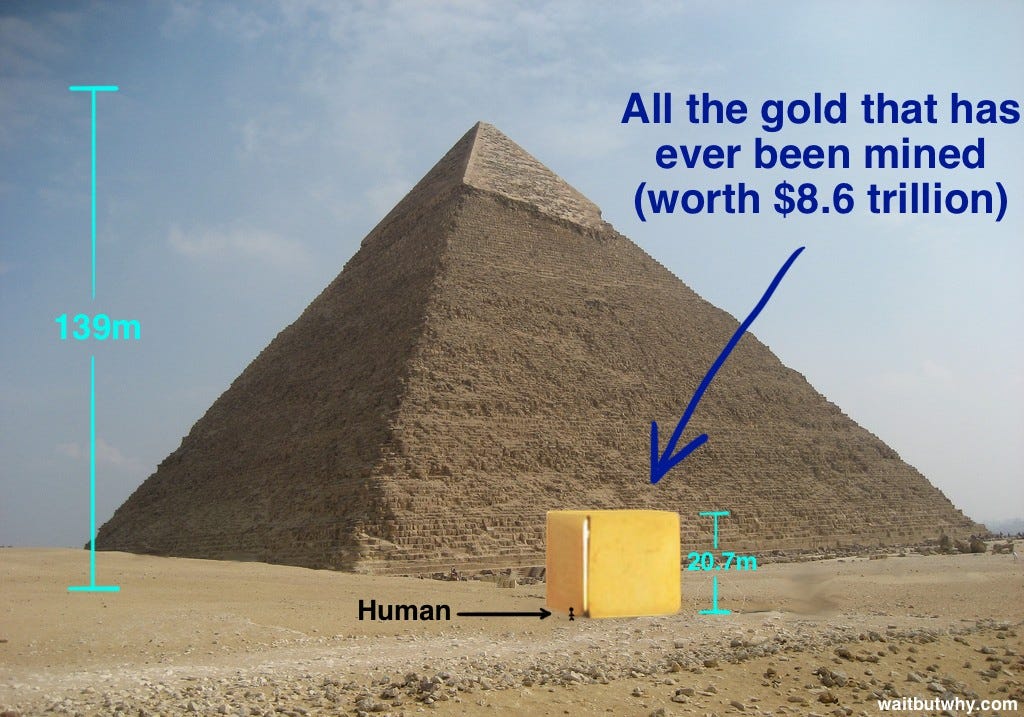

This image below puts into perspective just how little gold there is in the world today.

So gold is a stable store of wealth, especially when cash is rapidly losing its value.

But gold does have its drawbacks. It requires a lot of expensive infrastructure to store. Think of Fort Knox.

And it’s not easy to use. Imagine paying for a pizza with gold.

This is where Bitcoin comes in.

First, it cannot be devalued by a Roman emperor or government printing machine. There will only ever be 21 million Bitcoins and not a single coin more.

In fact, there will be fewer coins than 21 million because people are regularly losing their Bitcoin passwords and therefore access to their Bitcoin.

It’s estimated that 20% of all Bitcoins have already been lost forever, like this San Francisco man who lost over $200 million worth of Bitcoin because he forgot his password.

This is bad for obvious reasons to the people involved, but it’s also good in the sense that it makes the remaining limited supply of Bitcoin even more valuable.

The second advantage of Bitcoin over gold is that it’s easy to use for transactions.

You can use Bitcoin to buy almost anything today from coffee at Starbucks to NFL tickets and flights in Norway.

Paypal just approved the use of Bitcoin at 28 million merchants.

You can even buy pizza with Bitcoin, as Laszlo Hanyecz famously did 10 years ago. Though Laszlo is probably kicking himself today because the 10,000 Bitcoin he spent on those two pies would be worth over $300 million now.

This picture of Laszlo with his pizzas tells us a lot about Bitcoin. Not only can you buy almost anything with cryptocurrency, it’s worth a hell of a lot more today than it was back then.

Bitcoin is digital gold and the future of money.

Inflation isn’t the only reason to invest in blockchain technology, of which Bitcoin is just one part. There are several other compelling reasons as well, including privacy.

The government and Big Tech are becoming powerful at the expense of our right to just be left alone. I believe we’re seeing the start of a privacy revolution and that demand will soar for technology which shields us from over-zealous politicians and tech CEOs.

We’re already seeing this with people ditching WhatsApp for Telegram and the rise of MeWe as an alternative to Facebook.

I also recently switched from Google Chrome to a browser called Brave, whose decentralized Web network is much more resistant to censorship. It also has strict privacy protocols and an interesting set-up for ads.

Not only can you control how you see ads, Brave also distributes some of the revenue from advertisers directly to you, the viewer, in the form of crypto currency.

So instead of Google harvesting billions of advertising dollars from the sale of our time and data, we benefit directly ourselves.

The result is a weaker Big Tech company and a more empowered individual.

This, in a nutshell, is the beauty of blockchain technology and why I’m happy I finally got on board all these years after that memorable night in the Spiffy Dapper.